Published on Tuesday, September 17, 2024

US | The quest for a soft landing begins

Summary

Fed’s focus has shifted to the labor market and, in view of monetary policy lags, achieving a soft landing is now its main worry. This means the FOMC will not wait for weak labor market conditions before softening the policy stance.

Key points

- Key points:

- The continued strength of consumer spending despite some survey-based pessimism suggests the Fed is more likely to deliver a 25 bp rate cut this week.

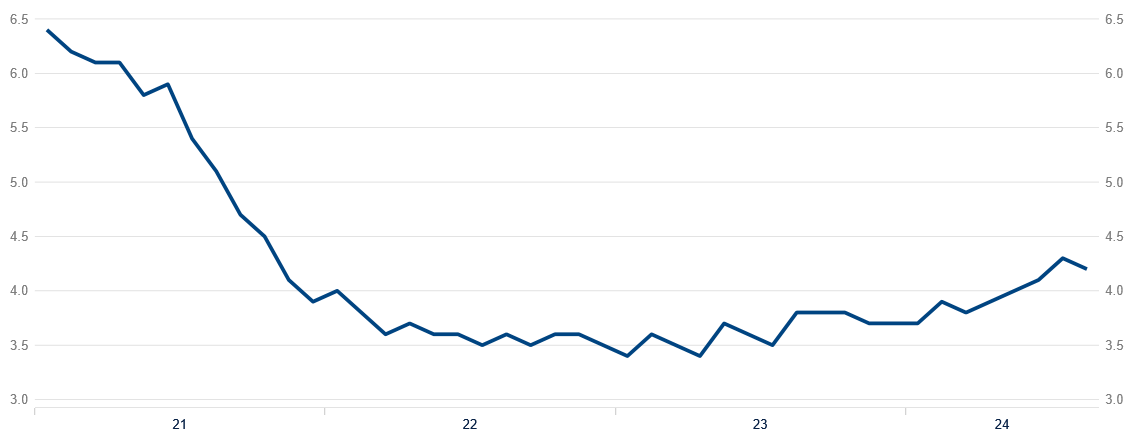

- Weaker-than-expected jobs data raised concerns of a recession and a more aggressive Fed’s response, but we think the “gradually-rebalancing” narrative still holds.

- Inflation concerns have largely left the spotlight, but the stickiness of housing inflation will likely prevent the Fed from explicitly declaring victory on this ground.

- Despite the futures market’s consensus on the initial movement direction, opinions remain split on the magnitude, with a 60% implied probability of it being 50 bps.

- We now expect a rate cut cycle of consecutive 25bp rate cuts at each meeting until the fed funds rate comes down to 3.0%.

UNEMPLOYMENT RATE

(%)

Source: BBVA Research / BLS

Geographies

- Geography Tags

- US

Topics

- Topic Tags

- Central Banks

- Financial Markets

Documents and files

Authors

Was this information useful?